Frinans

Frinans is a web app that helps young adults simplify their finances by providing a platform to handle their money by monitoring budgets, saving more to reach financial goals, and taking control of their financial life.

The Problem

During my walks of life, I have seen many people in my circle struggle in managing their finances. Most schools usually do not equip us with the basics of money management such as budgeting or investing.

So I wanted to rethink the way people could make wise financial choices for everyday living, and eventually building healthy financial habits.

The Solution

My solution was an app called Frinans that helps young adults simplify their finances by providing a platform to handle their money by monitoring budgets, saving more to reach financial goals, and taking control of their financial life.

Research

I began researching my potential users through surveys and user interviews to gain a better understanding of users’ motivation and behavior around budgeting, on the context in which users would need and use a budgeting app, and learn more about the user's pain points in interacting with the existing budgeting app.

USER SURVEY

I surveyed 38 people regarding their behavior on personal finance management, also their experience and pain points in using other money management apps. Here are my main findings:

- 47.4% respondents don’t have a budget plan.

- 70.8% respondents (who have the budget plan) document it manually.

- 29.2% respondents have used budgeting app(s).

USER INTERVIEWS

After collecting initial survey information, I interviewed 4 people to dig deeper into their finance management habits. Here are some of the main insights I gathered.

- Categorization. All interview participants faced frustrations when it comes to the wrong categorization e.g. when someone buys stocks for investment, the app categorizes it as an expense instead of investment. Most of them also would like to be able to set customized categories.

- Data visualization. Presenting visualization of the user’s financial data and progress into bar graphs or pie charts is found to be very helpful by all participants.

- Family account. People who live or share expenses together would like to be able to monitor their expenses in one place, so they can track e.g., who has paid which bill or expense, or how much that person has paid.

- One-stop service. Participants want a one-stop service where they get the aforementioned wants & needs in one place, without having to open another tab or app.

- Bill payment tracker. Participants want to be reminded about their obligations (bills & subscriptions), and also receive suggestions on which subscriptions they can skip to save more money.

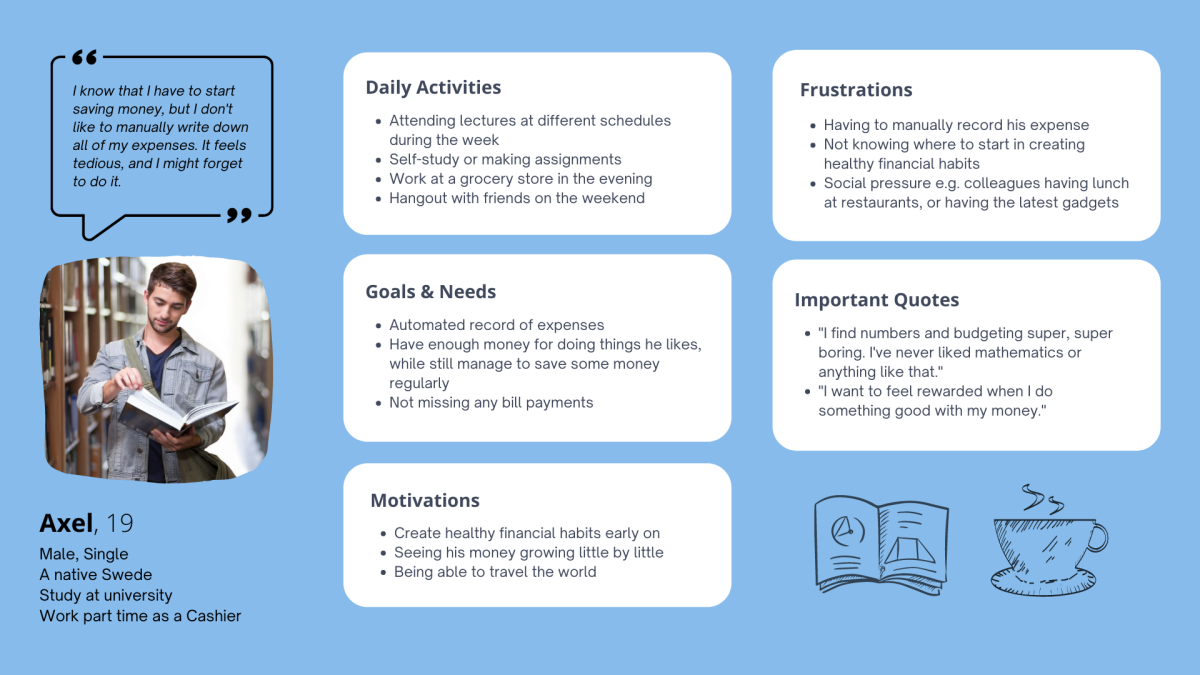

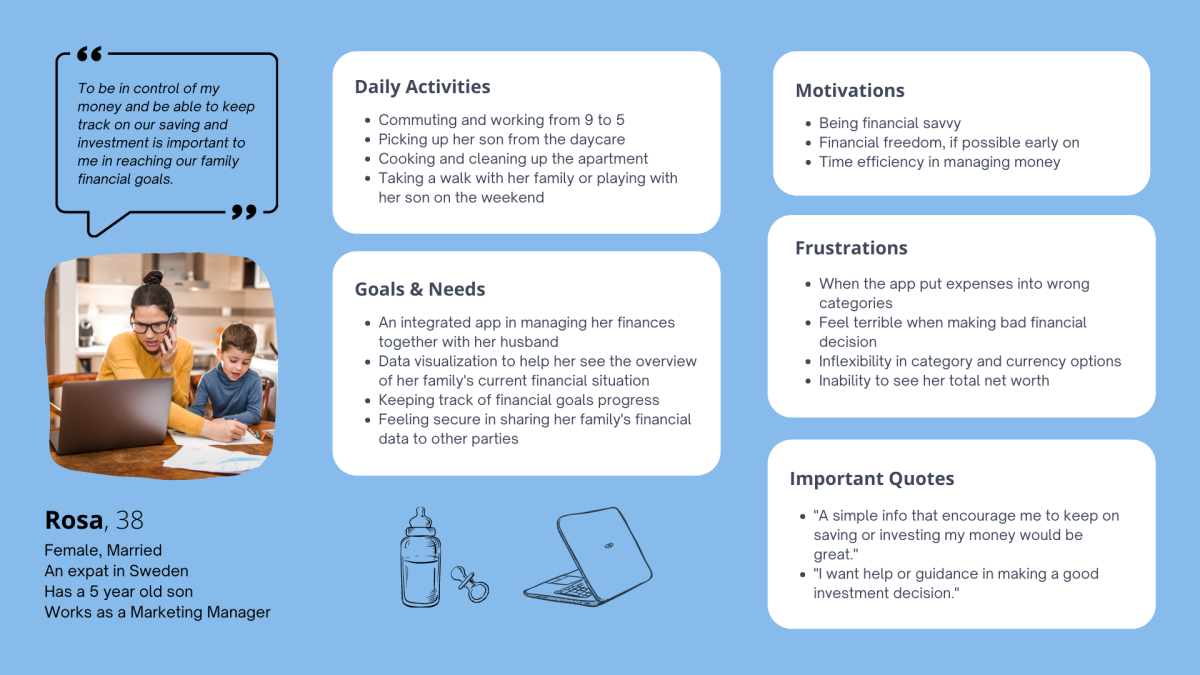

PERSONA

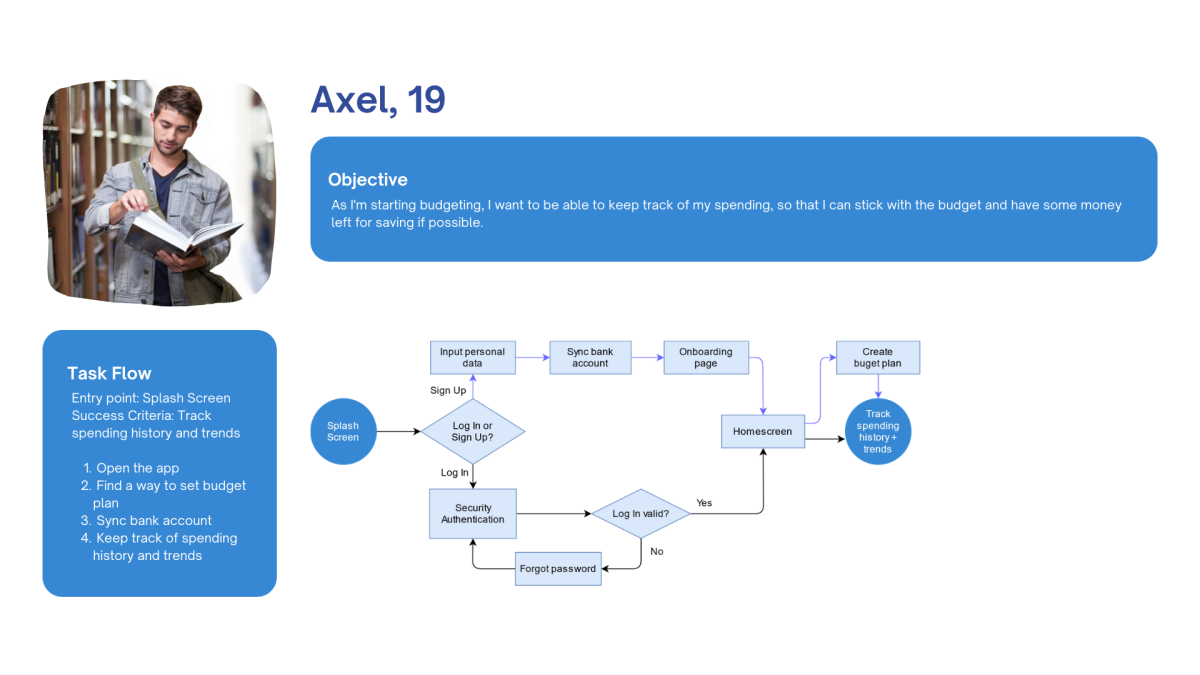

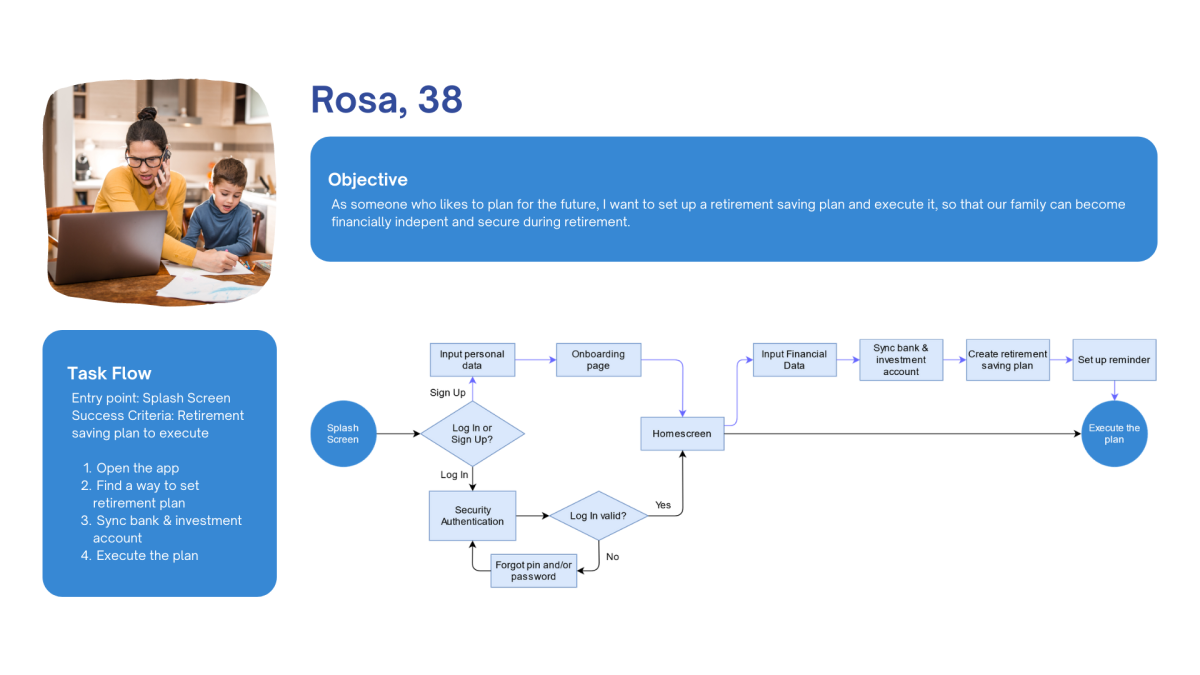

Based on my research data, and also to ensure my potential users always have a place when it comes to design decisions, I created two personas: Rosa and Axel.

Ideation

After gathering insights and data on my potential users I started organizing the structure and flow of my product.

USER FLOW

To help me in discovering what pages or screens of a web app are needed before I begin the information architecture phase, and also to help me in communicating with the developers of how the product works, I created some User Flows.

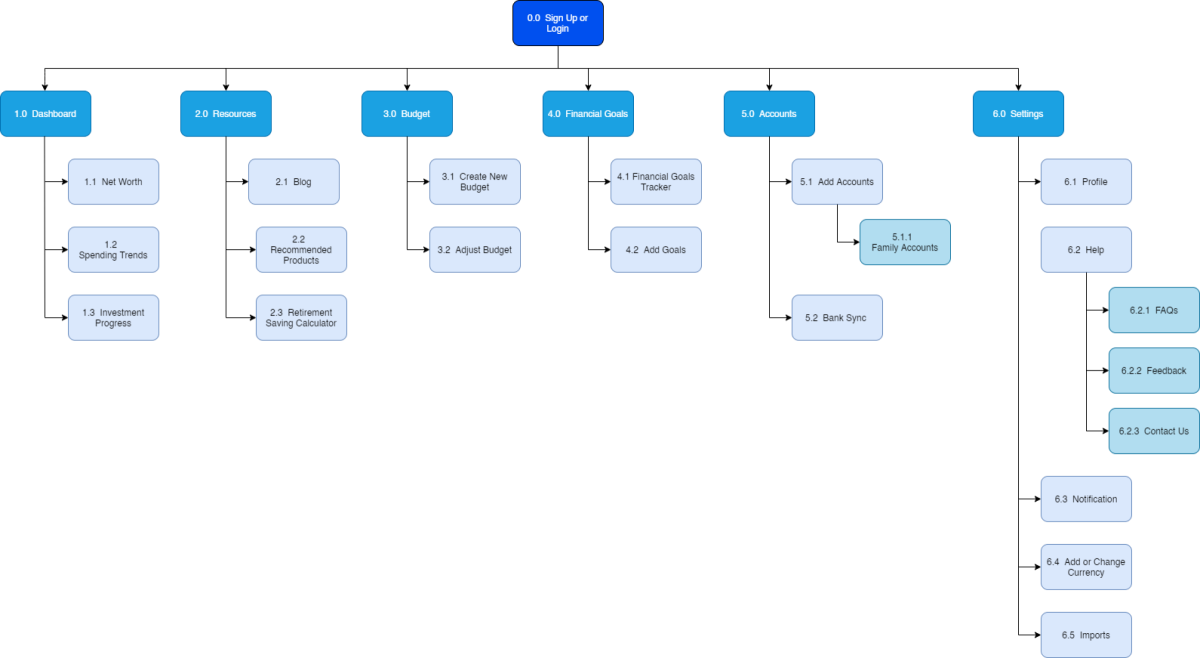

SITEMAP

With my user flows in mind, I began to lay out the structure of my product.

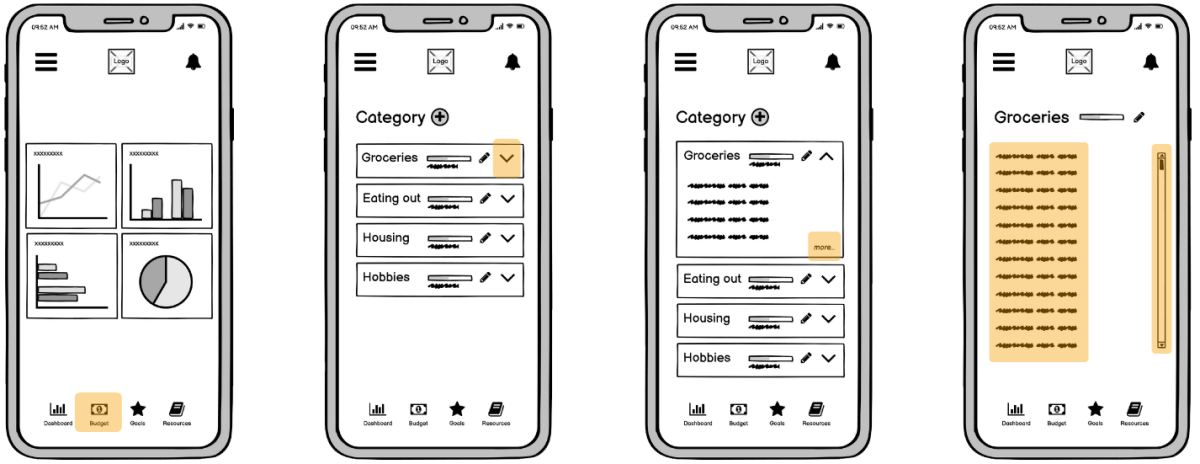

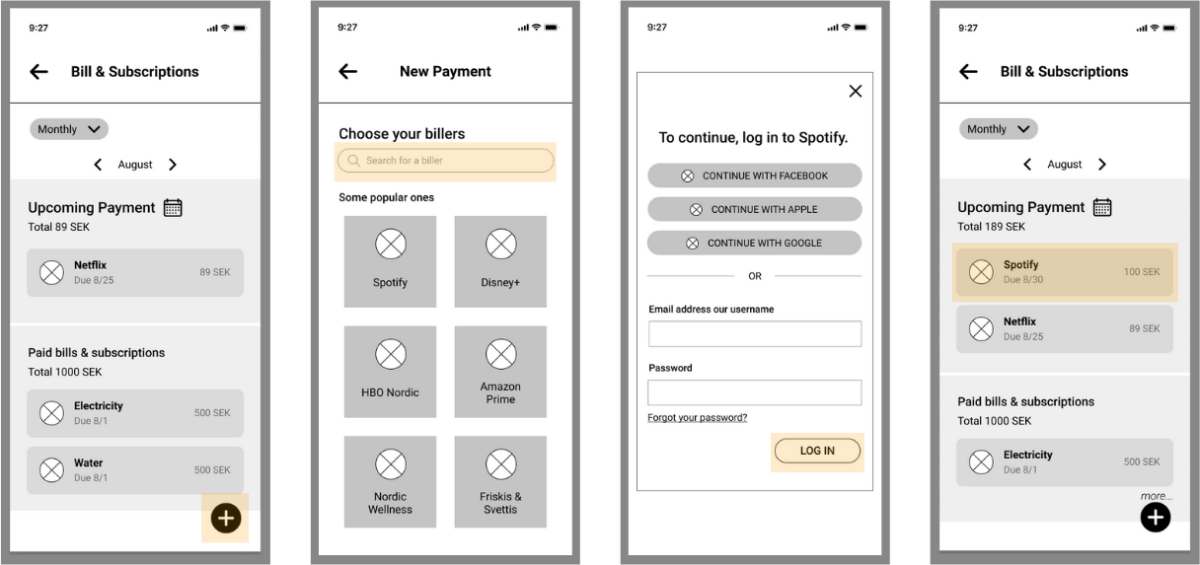

Wireframe

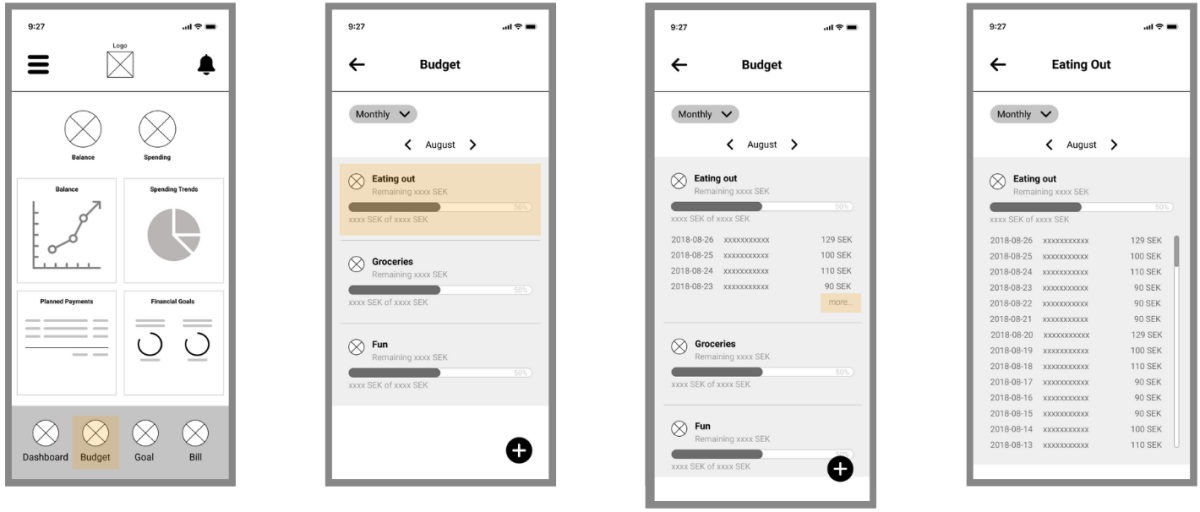

Once I have made the user flows and sitemap, I started with low fidelity sketches to allow me to create many different mockups quickly before landing on the initial layouts and then translated them into the first iteration of mid-fidelity wireframes.

BUDGET TRACKING

Low Fidelity

Mid Fidelity

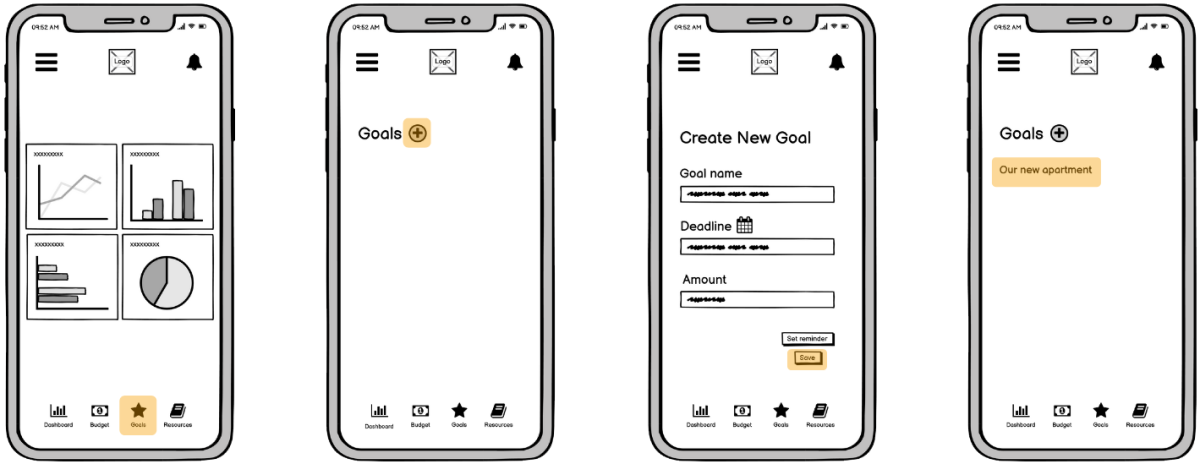

FINANCIAL GOAL TRACKING

Low Fidelity

Mid Fidelity

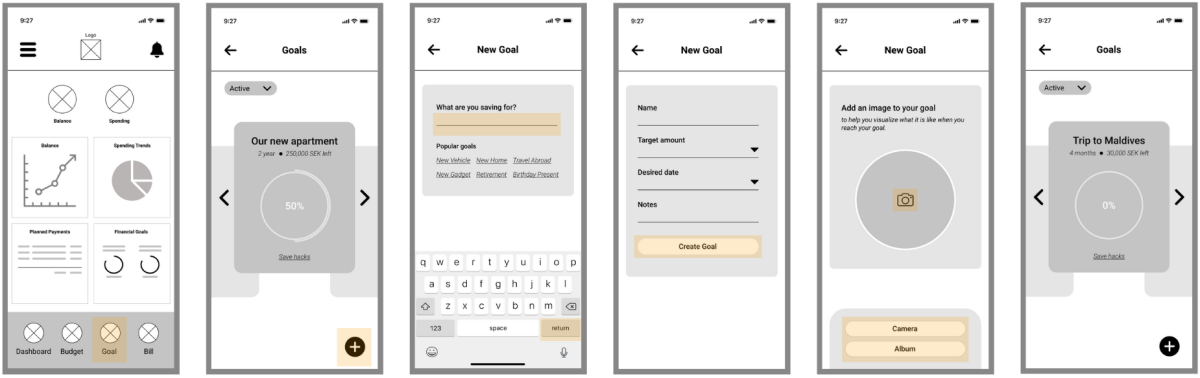

BILL PAYMENT TRACKING

Mid Fidelity

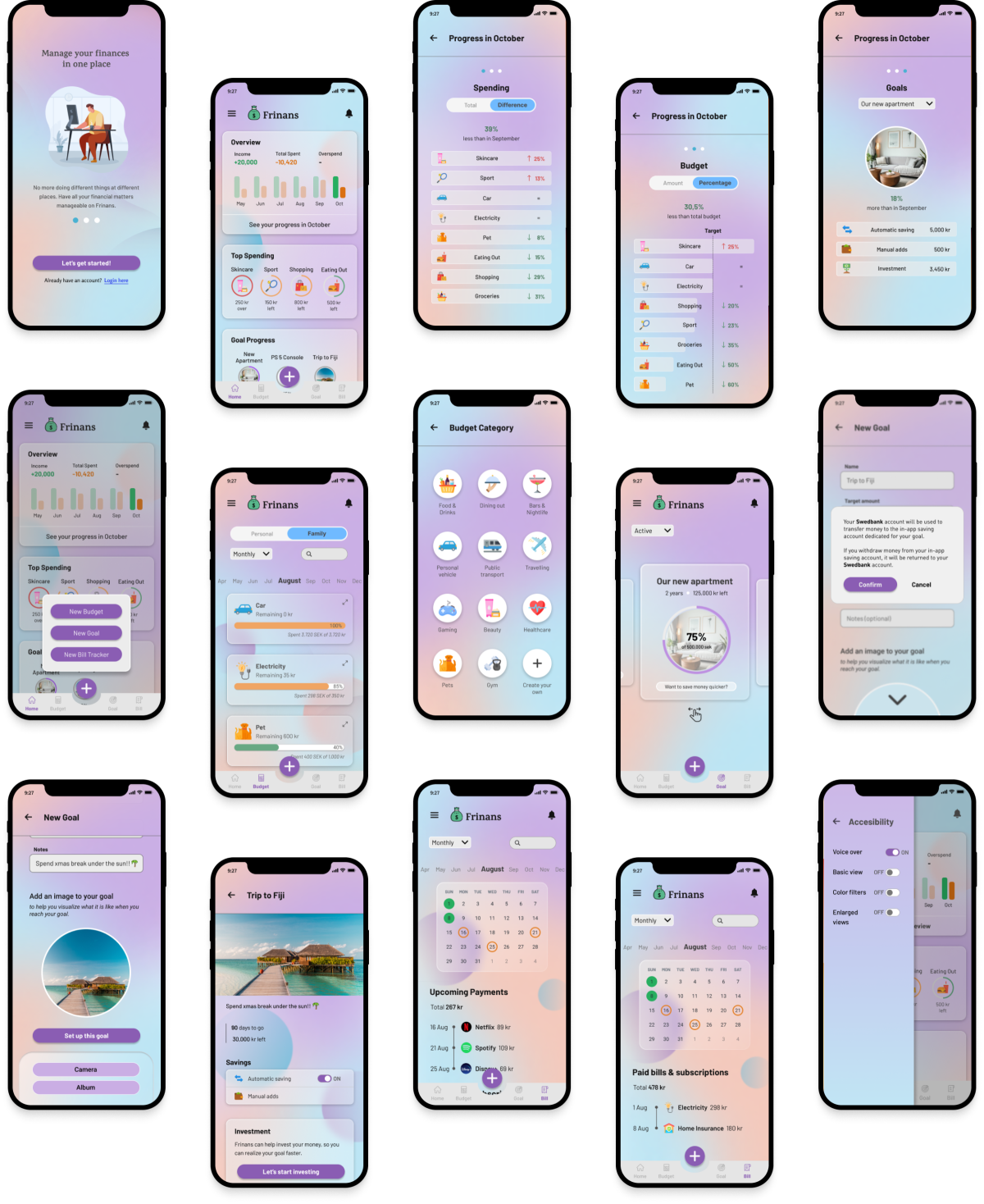

Final Design

After much research, testing, and many iterations I landed on my final design.

Click here to see the interactive

prototype made

in Figma!

CONCLUSION

Future Direction

- Explore other helpful features for the young adults e.g., easy-to-digest learning resources and guidance on more advanced topics like building net worth and improving credit scores.

- Consider working with an SME (subject matter expert) in investment to expand the investment feature incl. help beginners to easily learn by doing in the app.

- Implement personalized suggestions based on users’ activities data.

Lessons Learned

- Don’t assume you know the users. Test the hypothesis with users until patterns emerge, and dare to implement changes accordingly (even after hi-fi prototyping).

- User interview is not like chatting with people. The user researcher needs to ask the right question in a certain way, so the participant’s answers will be free from faking good and biases. This skill is something I am still improving on, therefore I am currently reading “Interviewing Users” book by Steve Portigal.

- A realistic project has to have a good balance between advocating for users’ needs and also business goals. Because the business cannot support the users if the business itself is unable to make a profit and keep running.